WASHINGTON – Lower financial literacy among Americans, especially those 65-and-older and those with disabilities, creates challenges for long-term money management, experts and nonprofit leaders told lawmakers on Thursday.

“Seniors end up as greeters at Walmart when they should be enjoying the golden years of their lives,” said Dorothea Bernique, founder and executive director of Increasing H.O.P.E. Financial Training Center.

Bernique blames a lack of knowledge, money and money management skills.

Increasing “just-in time” financial literacy – getting guidance as they’re making decisions such as claiming social security, enrolling in Medicare and annuitizing a 401(k) – can be pivotal for seniors and those with disabilities.

And though the focus of the Committee on Aging Panel is older Americans, the lawmakers and experts also discussed resources at the federal, state and local levels to promote financial literacy for all age groups, even young students, as financial knowledge among U.S. adults has decreased over time.

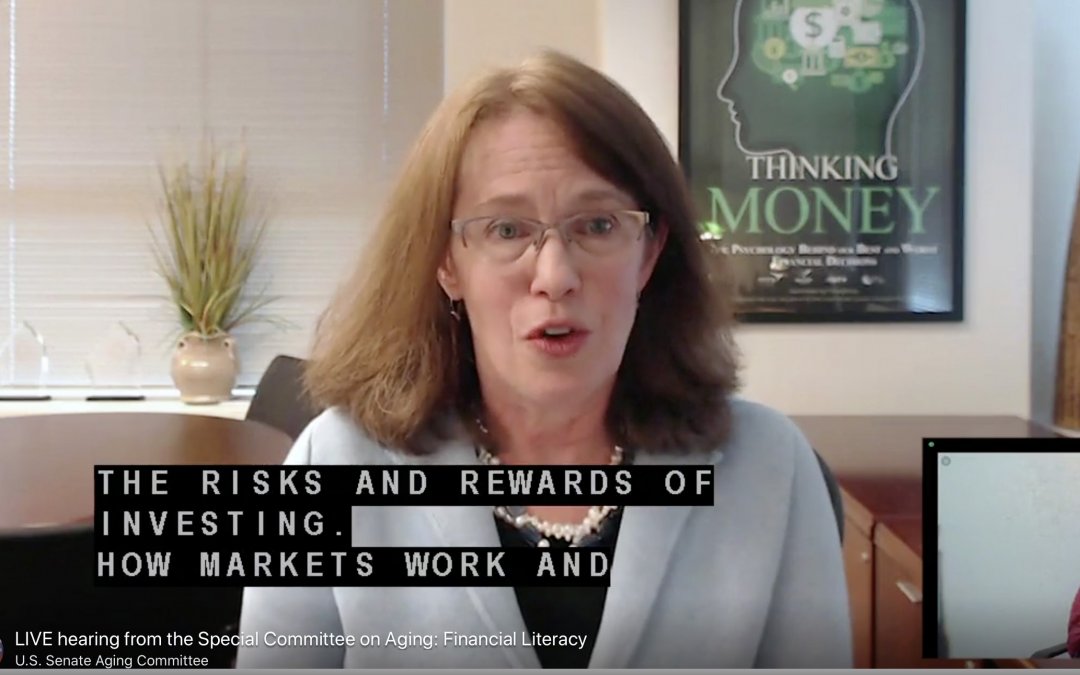

“In 2009, 42% had high financial literacy,” said Gerri Walsh, Financial Industry Regulatory Authority (FINRA) senior vice president of Investor Education. “By 2018, only 34%, and an early look at the 2021 data collection suggests levels have fallen slightly further.”

Yet Americans with disabilities face additional concerns, including higher spending and less access to financial education.

“To have a disability, it just simply costs more,” said Thomas Foley, executive director of the National Disability Institute, told MNS.

Precisely an additional $17,690 a year, if the individual with disabilities cannot work, according to research by the institute.

“Making sure that not only that there are policies in place to remove these barriers to financial inclusion, but then that the financial education materials and curriculum are… accessible to people with disabilities,” Foley said.

But Sen. Elizabeth Warren, D-Mass., said for certain individuals, improved financial education does not mean improved financial wellbeing.

“Low income families navigating a thin social safety net that gives them too little help, all the education and counseling in the world can’t magically make two plus two add up to ten,” Warren said.

Sen. Mike Braun, R-Ind., raised doubts on increasing financial education at the federal level.

“I look at the federal government, it’s really nice to see a place dispensing that valuable information, maybe prefacing a little bit in terms of what it tries to preach,” Braun said.

This year, the committee has zeroed in on financial literacy as the focus of its annual bipartisan report, released on Thursday.