WASHINGTON — Thomas and Elfriede Flavin lost over $80,000 to someone claiming on Facebook to represent their grandson, leaving them with barely enough money from Social Security and pensions to cover daily living expenses, their daughter told the Senate Special Committee on Aging Wednesday.

Erika Flavin said the so-called “grandparents scam” began on Facebook and eventually the couple sent money to a lawyer claiming to represent their grandson who the lawyer said had wound up in jail after a drunk driving accident.

An estimated $3 billion is stolen from seniors each year through various scams, according to the Justice Department, a number that is increasing as along with the growing senior population. In addition, the median net worth of a U.S. households with at least one resident age 65 or older has risen to more than $240,000 – making the elderly an enticing target.

“Although the scams we have examined differ in scope and structure, one factor is common to all — the fraudsters need to gain the trust and active cooperation of their victims,” Committee Chairman Sen. Susan Collins said. “Fighting these scams requires a coordinated response led by the federal government, in close cooperation with state and local law enforcement, the private sector, and stakeholder organizations.”

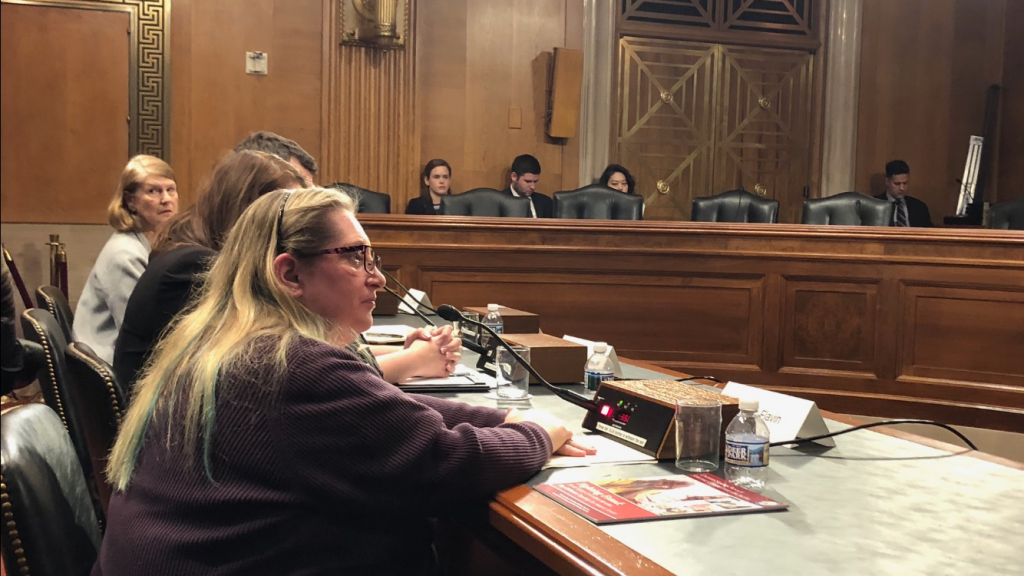

Erika Flavin listens to questions from Sen. Josh Hawley, R-Mo., on how banks can reduce financial fraud for senior citizens. (Henry Erlandson/MNS)

Pennsylvania Sen. Bob Casey, the top Democrat on the committee, pointed to the Senior Safe Act, which Congress passed and the president signed last year, as an effective tool to combat elder abuse. The law enlists financial institutions to help senior citizens avoid financial fraud by allowing banks, credit unions, investment advisers and brokers to report suspected fraud to local law enforcement without fear of being sued.

But even with the law, seniors rarely report due to denial or fear of reprisal, Casey said.

“We know that as we get older, we fear the loss of our independence so it’s a great fear for our elders to come forward,” said Candice Simeoni, founder and president of the York County Elder Abuse Task Force. In Pennsylvania “They may think they will end up in a nursing home.”

Collins stated that scammers rely upon technologies like caller ID “spoofing,” robo-calling, wire transfers and gift cards to perpetrate their schemes.

Sens. Kyrsten Sinema, D-Ariz., and Martha McSally, R-Ariz., expressed concern that many of the people moving into the state of Arizona are seniors and will inevitably settle in certain rural areas that can be hard to reach if a fraudulent crime occurs.

Arizona expects 100,000 people to move into the state in 2019, while Florida, a popular retirement destination, predicts 400,000 new state residents, Sinema and Sen. Rick Scott, R-Fla., said.

“A multidisciplinary approach is absolutely indispensable at the local and state levels,” said Kansas Attorney General Derek Schmidt. Schmidt noted that the vast majority of elderly crimes are handled by state and local authorities.

He said partnerships could be built with federal agencies that tend to operate in more populous states and cities.