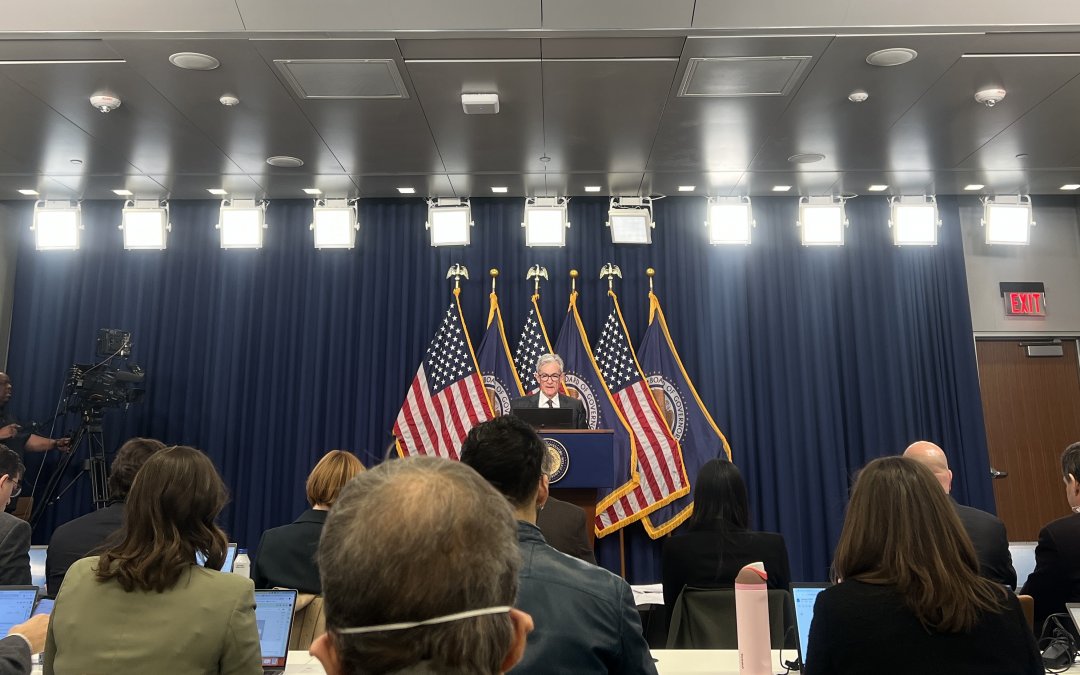

WASHINGTON – After three consecutive rate cuts, Federal Reserve Chair Jerome Powell announced Wednesday the Fed will hold the federal funds rate constant at 4.25-4.50%.

During its first meeting of 2025, the Fed decided it would not act amidst “somewhat elevated” inflation and a “strong” economy as evidenced by the low unemployment rate.

“Right now, we feel like we’re in a very good place. Policy is well positioned. The economy is in quite a good place,” Powell said.

The Fed’s decision to hold rates comes after data from the Labor Department’s December Jobs Report showed a solid labor market, with jobs increasing by 256,000 and the unemployment rate falling to 4.1%. The Consumer Price Index, a general measure of inflation, rose to 2.9% in December. However, the core Consumer Price Index, an inflation measure that excludes volatile food and energy prices, fell to 3.2%.

Before September, the rates stood at 5.25-5.50%, the highest level in two decades, as the Fed worked to reduce inflation. The Fed had since cut rates by a full percentage point during its past three meetings when inflation showed signs of falling towards the Fed’s 2% goal and the labor market exhibited signals of weakness.

In response to the question of a March rate cut, Powell hinted that the committee did not “need to be in a hurry to adjust our policy stance.” He noted that inflation was on a “slow and sometimes bumpy” road. Powell said, however, that inflation did not need to fall to the Fed’s target before the committee cut rates again.

Powell faced questioning about whether the Fed would resist President Donald Trump’s demand that the Fed and Powell lower rates if Trump brought down oil prices. Powell reaffirmed the committee acts independently and that he had not communicated directly with Trump about his demands.

“Lots of research shows that’s the best way for a central bank to operate,” Powell said about the Fed’s independent role from the rest of the government. “That will give us the best possible chance to achieve these goals for the benefit of the American people. That’s always what we’re going to do, and people should have confidence in that.”

The meeting came at a time of high policy uncertainty. Powell mainly withheld comment on Trump’s actions as president. Recent executive orders from Trump regarding issues such as immigration, tariffs and regulatory policy had been at the center of economic debates on inflation and the job market. Trump critics have argued his tariffs and immigration policies could have an inflationary effect.

He said before the Fed can begin to make a “plausible assessment” of the policies’ implications, the committee needs to see the policies fully implemented.

Some economists believe these factors will be critical for the Fed to consider at future meetings.

“I think both (immigration and tariffs) will be important to decision-making going forward,” said Donald Kohn, a Senior Fellow for Economic Studies at Brookings.

Kohn said a crackdown on immigration will both reduce the workforce and simultaneously reduce the demand for certain goods and services, and it was unclear what the impact will be on prices. As for tariffs, he said they tend to raise prices for consumers but the dollar could strengthen as a result, which may partially offset price increases. Kohn noted the Fed would likely keep a close eye on this balance.

While investors and economists waited attentively for today’s meeting, the Fed’s move was expected.

“They are in wait-and-see mode, to collect more evidence about whether the downward drift in inflation resumes, how strong the labor market proves to be, and what economic policies the Trump Administration actually implements,” wrote David Wilcox, a senior fellow at the Peterson Institute for International Economics and Director for US Economic Research at Bloomberg in a statement to Medill News Service.