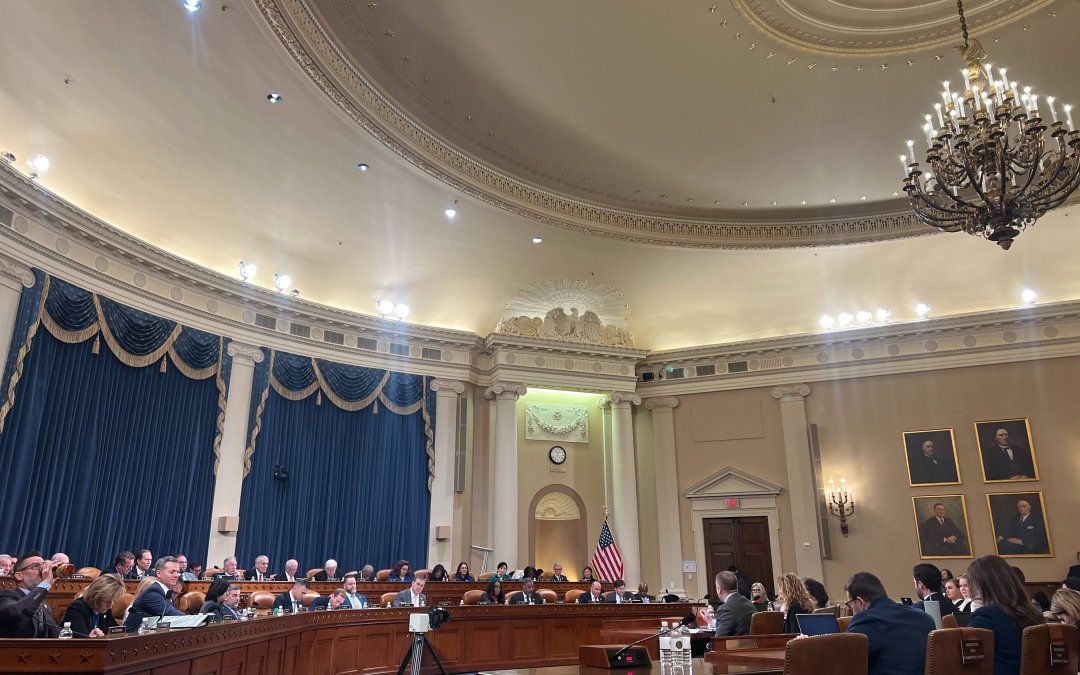

WASHINGTON – With the clock ticking down on the Tax Cuts and Jobs Act, House Republicans in the Ways and Means Committee doubled down Tuesday on demanding a permanent extension of the tax cuts.

“As of today, we have only 142 legislative days before taxes will go up for every single American if Congress fails to act,” Rep. Jason Smith (R-Mo.) said to begin the committee hearing. “One year from now, the paychecks of every working American will look a lot different as on average, their taxes will go up 22%.”

Republicans and Democrats sparred over whether the tax cuts positively affected working families and small businesses during the hearing “The Need to Immediately Make Permanent Trump Tax Cuts for Working Families and Small Businesses.” American citizens, across nearly all income levels, could see changes to their taxes depending on how the new Congress resolves this dispute.

Key provisions of the act – such as a doubling of the standard deduction, expansion of the child tax credit and lower individual tax rates – are set to expire Dec. 31, 2025.

House Democrats disputed the claim that the tax cuts served working and middle-class individuals. Democrat representatives argued these previous tax cuts skewed toward aiding the wealthiest Americans and corporations. The act permanently cut the corporate tax rate to 21% from 35%. Additionally, after-tax income rose by 3.4% for the top 1% of Americans compared to a change of 0.4% in after-tax income for the lowest quintile of Americans, according to the Brookings Institution.

“Republicans claim those tax cuts ‘trickle down’ to everyone else but slashing the corporate income tax only further lined the pockets of billionaires, executives and shareholders,” Rep. Linda Sanchez (D-Ca.) said. “Republicans love to claim that they are helping working families but the fact of the matter is, under their policies, working families only get the crumbs.”

Republican lawmakers pushed back by asserting the corporate tax cuts created more jobs for working and middle-class individuals. Losing the tax cuts would eliminate many of those jobs. According to Smith, five million jobs were created in the two years following the tax cuts.

The national deficit was another focus of Democrat lawmakers during the hearing. Rep. Richard Neal (D-Ma.) cited that making the tax cuts permanent would add $4.6 trillion in debt over the next 10 years. Brendan Duke, the senior director for economic policy at the Center for American Progress, said that the future cost of the tax cuts could be cut by more than half by not continuing the tax cuts for the top 2%.

Democrats warned that the loss in revenue from extending the tax cuts could require Congress to cut spending for federal programs such as Medicare and Social Security. William Gale, the co-director of the Urban-Brookings Tax Policy Center, told Medill News Service that low-income households would be more economically hurt by potential spending cuts to federal programs than the benefit they would receive from the reduction in their taxes.

During the hearing, Republican representatives probed the witnesses representing small businesses with questions about how the act helped them. Rep. Vern Buchanan (R-Fla.), in his question to Courtney Silver, the president of a manufacturing company, stressed the importance of the way the act allows businesses to fully deduct the cost of new investments from their taxable income.

Earlier this month, Buchanan introduced a bill to the House to make sections of the Tax Cuts and Jobs Act that impact individuals, families and small businesses permanent.

“The TCJA was rocket fuel for the American economy,” Buchanan said.