WASHINGTON — Amid rising concerns over a surge in investment scam losses and the potential compromise of citizens’ privacy, the Committee on Financial Services convened on Wednesday to scrutinize the operations of the Financial Crimes Enforcement Network (FinCEN) and the Office of Terrorism and Financial Intelligence (TFI).

Republican lawmakers expressed dissatisfaction with FinCEN’s efforts, emphasizing the need for increased transparency and accountability in the face of evolving financial threats.

Rep. Pete Sessions (R-Texas) voiced concerns about the increase in investment scam losses, citing a Federal Trade Commission study that reported $10 billion in nationwide fraud losses in 2023 and more than $4.6 billion in investment scam losses, a 14% increase compared to 2022.

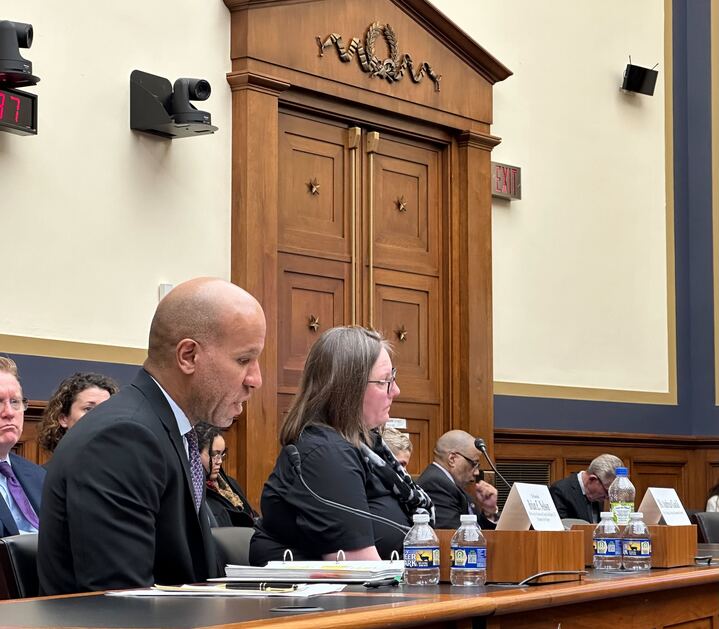

“I’ve heard both of you coming in and reporting the good work you’re doing,” said Sessions, addressing Brian Nelson, the Undersecretary for Terrorism and Financial Intelligence, and Andrea Gacki, the director of FinCEN. “I’d like to see what you can drill down to see the huge losses occurring. This committee, on a bipartisan basis, is concerned about real threats.”

Lawmakers also expressed concern over the intrusion into citizens’ privacy regarding purchases, such as Bibles and legal guns.

“There is a pressing need to establish clear limits on data requests, ensuring that constitutionally protected activities are not subject to unwarranted scrutiny,” said Rep. Ann Wagner (R-Miss.). “The public deserves a comprehensive briefing from the TFI and FinCEN to address these concerns and provide transparency on the government’s justifications for such information requests.”

Gacki assured that legal purchases, including firearms and religious materials, are not the primary targets of these requests. However, the call for clear limits on data requests and heightened transparency remain essential to addressing constitutional concerns.

“Our national security measures must be balanced,” Chairman Patrick McHenry (R-NC) said. “FinCEN is one of the least known but most powerful agencies.”

Lawmakers probed the effectiveness of FinCEN and the TFI in their efforts to combat terrorism. Rep. Frank Lucas (R-Okla.) highlighted the connection between numerous bonds and terrorist activities, underscoring the importance of pinpointing these elements within the international financial system.

Nelson pointed out different prominent players according to the TFI’s investigations, including Iran, Lebanon and Iraq, where several militia groups operate, providing insights into how their location intertwined with these financial dealings.

“Congress intended to enhance our national security by preventing bad actors like China, Russia, and Iran from using the financial system for illicit purposes. We did so by creating a more beneficial ownership reporting,” McHenry said. “This reporting regime was supposed to read the financial systems of bad actors by going after the shell companies often used by foreign advisors to hide the proceeds of trafficking and terror financing.”

Nelson highlighted the department’s efforts in countering various threats to the U.S. financial system, ranging from the Russia-Ukraine conflict, imposing sanctions on Russia, and combating terrorism financing in the Middle East, particularly Hamas. In his witness statement, Nelson provides insights into the measures taken against Russia, including sanctions, price cap policies, and efforts to prevent evasion tactics.