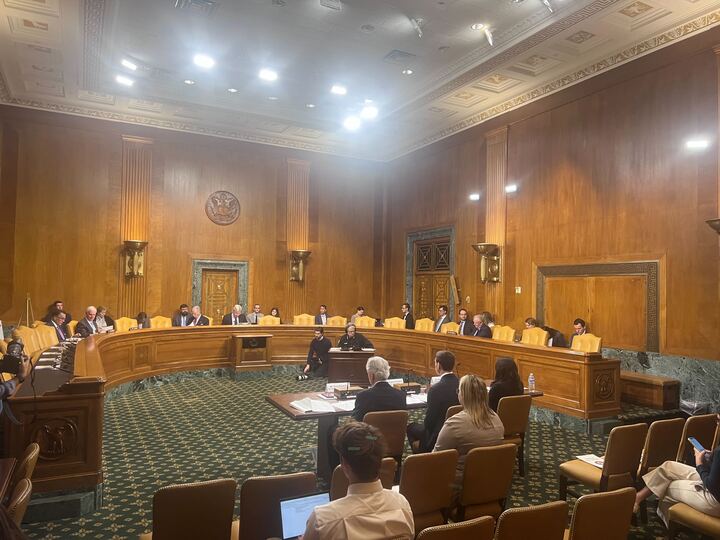

WASHINGTON — Senators condemned the loopholes some of the wealthiest Americans have used to avoid and evade paying taxes and sparred over the best ways to maximize IRS effectiveness during a Budget Committee hearing on Wednesday.

Democrats on the committee argued that increased IRS funding from the Inflation Reduction Act has allowed the agency to operate more efficiently by conducting more thorough audits and collecting owed funds.

But most Republicans countered that claims of tax cheating by wealthy Americans are “exaggerated” by an already bloated government to justify collecting more money for federal spending. Sen. Ron Johnson, R-Wis., even suggested that increased IRS enforcement of wealthy Americans is punishing success.

Despite spirited disagreements, however, all of the expert witnesses called to testify agreed that better tax enforcement actually reduces the deficit. They further found that the House Republicans’ bill proposing to slash over $14 billion in IRS funding as part of a measure to provide aid to Israel would have raised the deficit, not lowered it, as House Speaker Mike Johnson, R-La, had claimed.

Natasha Sarin, a Yale law and finance professor, celebrated the progress the IRS has made since receiving the big boost in funding as part of the Inflation Reduction Act in 2022.

Sarin, a former counselor to Treasury Secretary Janet Yellen, testified that improvements in IRS function in the last year have been “remarkable.” She said increased funding for the IRS is “critical to the fiscal stability” of the United States.

“The idea of defunding the IRS as a ‘paid-for’ or an ‘off-set’ is fundamentally backwards,” Sarin said. “We can debate magnitudes, but we cannot debate the following fact: Adequately funding the tax administrator is a deficit-reducing measure that pays for itself many times over.”

The IRS’s most recent tax gap estimates found that more than $600 billion in owed taxes are uncollected each year, totaling nearly 3% of American GDP. According to Sarin, that amount could have covered an extension of the expanded child tax credit and lifted millions of American children out of poverty through 2025.

Sen. Mitt Romney, R-Utah, called out the House Republicans’ proposed cuts to the IRS and questioned the authenticity of their motives, notably splitting from other Republican senators.

“The idea that somehow we should reduce the number of audits and reduce the number of IRS agents and that’s going to make us more money is simple, clear and wrong,” Romney said. “It’s a demagogue approach, which is designed to say ‘Hey, we want to get people to vote for us because we’re going to promise them they can cheat on their taxes because there won’t be any audits.’ It’s just disingenuous.”

Other Republican committee members, however, rehashed tangentially related political inquiries rather than focusing on tax reform. Johnson focused his line of questioning on an alleged “dual system of justice,” which he claims targets wealthy conservatives but allows Hunter Biden and the Biden family at large to “grift.”

Sen. John Kennedy, R-La., spent his entire questioning time badgering Sarin about a post she uploaded on X, the platform formerly known as Twitter, accusing the House Republicans of exploiting urgency to send aid to Israel to defund the IRS and allow wealthy people to “cheat on their taxes.”

The senator also directed personal insults toward Sarin, suggesting that she is “immature” and implying she is not a credible witness.

Chairman Sheldon Whitehouse, D-R.I., denounced Kennedy’s approach to questioning Sarin, expressing concern with the way witnesses have been treated on the committee.

“I think personal insults to witnesses are not appropriate and I will not be tolerant of that in this committee,” Whitehouse said.

Whitehouse continued on to say that even though senators are entitled to test the credibility of witnesses, as chairman he is also entitled to protect witnesses from “bullying.”

Later in the hearing, Sen. Tim Kaine, D-Va., addressed Kennedy’s mischaracterization of Sarin’s tweet, clarifying what the witness actually meant by her criticism of House Republicans and rooting out any misunderstandings of her position.

Democratic senators touted reform proposals aimed at cracking down on tax cheats, including continuing to increase funding to the IRS to allow the agency resources necessary to investigate owed taxes and individuals of interest.

Sen. Jeff Merkley, D-Ore., said wealthy individuals’ ability to cheat on their taxes undermines the sense of fairness and participation in American democratic systems, like tax collection. He added that he was taken aback when he first went to college and listened to people from more affluent backgrounds boast that their families had found tax strategies to maximize their wealth.

“I live in a blue-collar community, and I think the sentiment would be universal that while we’re paying our fair share, the wealthy need to pay their fair share too,” Merkley said. “Many individuals in America see this not as the honor of doing their fair share as a citizen but see it as a game to be played to cheat the system as much as possible.”

Senators will have until noon on Thursday to submit additional questions for the record and the witnesses must respond to the questions within seven days of receipt.