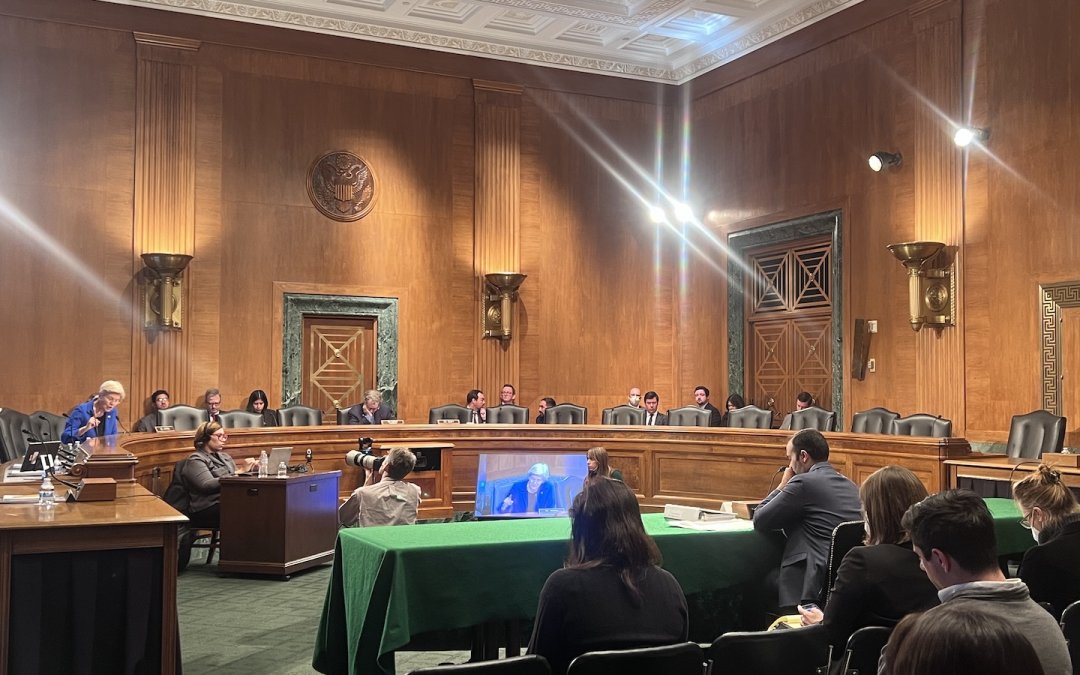

WASHINGTON — Senators discussed the Consumer Financial Protection Bureau’s role in preventing recessions by regulating banks and financial institutions and debated whether the agency is operating within its jurisdiction in a Senate Committee on Banking, Housing, and Urban Affairs hearing on Thursday.

The CFPB was created through the Dodd-Frank Act following the financial crisis of 2008. The agency is specifically designed to protect consumers from fraudulent, deceptive and predatory loans extended by bankers and lenders from financial institutions.

The Supreme Court is currently deciding whether CFPB regulations are constitutional because it receives its budget through the Federal Reserve, an independent agency, and not Congress itself. The court heard oral arguments in Consumer Financial Protection Bureau v. Community Financial Services Agency of America on Oct. 3.

Critics have argued that the CFPB’s funding structure allows it to operate as its own legislative body with outsized influence over the economy and with very few checks from the federal government.

Sen. Elizabeth Warren, D-Mass., led the push to create the CFPB in 2008 and served as the agency’s first special advisor under President Barack Obama. Warren said industry lobbyists are fighting back aggressively against the CFPB and the Biden Administration’s recent crackdown on junk fees because the corporations they serve have raked in a fortune from these charges. Just last year, credit card companies charged consumers $14.5 billion in late fees and credit card debt surpassed $1 trillion for the first time.

“The CFPB says that if a credit card company is charging more than $8 in late fees, the company is actually going to have to show its work, that is to show that it cost the bank more than $8 to deal with these late fees. Otherwise, $8 is the most that they can charge,” Warren said. “Now, the banks have responded to this proposed rule with their usual approach: howling about regulation and unleashing an army of lobbyists to swarm Congress.”

The CFPB announced in October that it has already forced big financial institutions to pay back $140 million in junk fees, most of which came from overdraft charges. CFPB Director Rohit Chopra said the agency is also deeply focused on clawing back funds from predatory credit card late fees.

In the last two years, the CFPB has obtained orders totalling $8 billion in victim redress and penalties, focusing on large, repeat offenders, according to Chopra. Since its last semi-annual report to Congress, the CFPB has also proposed a rule to shift to “open banking” in the U.S., which would make it easier for consumers to switch to new providers and safeguard their personal financial information simultaneously.

Chopra said families who live paycheck to paycheck and who reside in the lowest income bracket are usually the ones who end up paying for the expensive overdraft fees that banks and credit unions impose.

“We want people to be able to access credit, but sometimes it is not subject to the normal competitive forces and they can really be gouged,” Chopra said. “The vast majority of institutions I think are doing a good job, but there are many bad actors that we have to deal with.”

Republican senators argued that agencies like the CFPB stifle innovation by restricting the market when they impose regulations on banks and financial institutions. They also raised concerns about potential CFPB overreach by imposing particularly “aggressive” limitations.

Ranking member Tim Scott, R-S.C., said the CFPB is ignoring legal precedent and common interpretation of regulatory standards by imposing sweeping restrictions and regulations on banks and financial institutions. He suggested the CFPB is actually harming average consumers by stifling their opportunity to engage in the open market with innovation.

“The best way to provide economic opportunity and protect consumers is to encourage competitive markets and set clear rules of the road for participants,” Scott said. “These principles protect our system by fostering competition and innovation, rather than vilifying it.”

Chopra pushed back against the argument that CFPB is overreaching its jurisdiction by imposing fee regulations on large tech companies and payment apps.

The director said while he agrees that nursing competitive markets and increasing the role of technology in the open marketplace can help working Americans, he also believes in imposing consistent guardrails to protect consumers from bad actors.

“We are not expanding our authority, they are currently subject to our enforcement authority,” Chopra said. “Rather than resolving issues through litigation, we should look at those large firms serving tens of millions of people and make sure that they are following the law just like small banks are doing.”

The CFPB has also taken a special interest in protecting veterans and service members from deceptive lending practices and junk fees, as this demographic has been especially susceptible.

Sen. Jon Tester, D-Wyo., the chairman of the Senate Committee on Veterans’ Affairs, emphasized the importance of ensuring veterans are treated fairly after returning from active duty service and decried the predatory lending practices that have deprived them of earned government benefits.

“There are accredited veterans service organizations out there that help veterans access their earned benefits, but there are also a growing number of organizations trying to take advantage of our veterans for money,” Tester said. “(This) always tends to be the case when you have a steady flow of income into a community.”

Chairman Sherrod Brown, D-Ohio, echoed this idea, emphasizing the crucial role the CFPB plays in protecting former members of the U.S. armed forces, who are often plagued by deceptive practices employed by scammers, greedy corporations and shady lenders after they retire from service.

Brown said the CFPB’s enforcement of the Servicemembers Civil Relief Act, which intended to guarantee active duty service members and their families with a reduction in interest rates on any pre-service loans, is “one of the real highlights” of the agency’s work. He raised concern, however, that veterans and service members are not receiving all of the benefits they are entitled to and that Congress intended.

“I’m going to work towards ensuring financial institutions proactively check for reductions,” Brown said. “Our service members and families should be able to keep their money, as (the CFPB) continues to fight for.”

Senators will have one week to submit questions for the record, which witnesses will then have 45 days to answer as the future of the CFPB as presently constructed lies in limbo in the Supreme Court.