WASHINGTON — Small business owners told lawmakers on Thursday that new regulations enacted by the Department of Labor are hurting their productivity and claim the rules have led to bureaucracy and mounted costs which push their businesses out of the market.

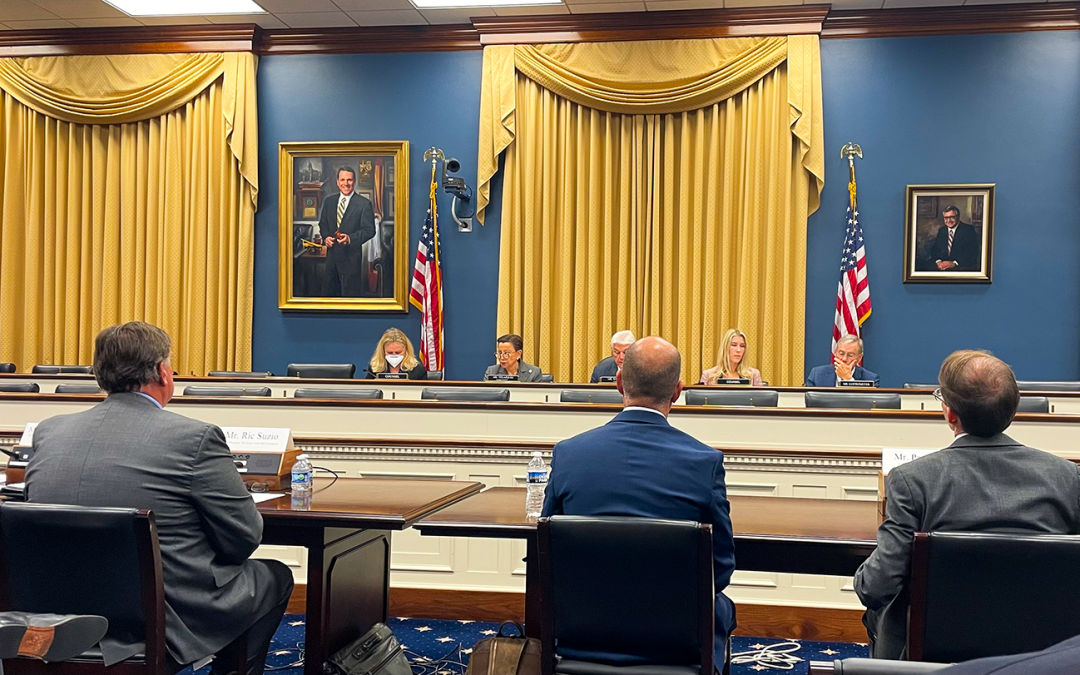

Mario Burgos, founder and former CEO of Burgos Group LLC, said a hearing by the House Committee on Small Business that he started his engineering business with his brother in 2006 and watched it grow to 195 employees working for 13 federal agencies across the country. In July, new regulations such as the updated Davis-Bacon Act led him to sell his business as it was no longer prudent to operate.

Burgos emphasized that the new prevailing wages implemented by the act were not his main concern, but rather the confusing and endless paperwork required of a small business.

“It’s impossible for small business to comply when the regulations are constantly being changed, and I would respectfully say the cost to small businesses in general is much much higher,” Burgos said.

According to Burgos, the Department of Labor estimated that it would cost a business $255 dollars – or 5 hours of paperwork – reading to comply with the changes to the Davis-Bacon Act, which he claimed were 800 pages of complicated legal jargon. He said he had been unsuccessful in finding a lawyer willing to do the job for that wage.

Rep. Dan Meuser (R-Pa.) said he empathized with the small business owners at the panel as he also owns a small business, and ultimately blames “Bidenomics” for the hardships they are facing.

“Highest inflation in our lifetimes, for some of us anyways, since the seventies. Losing our energy independence. Gasoline and groceries are certainly affected. Interest rates have an enormous effect on small businesses,” Meuser said.

Meuser added that these regulations have been detrimental not only for small businesses but for the federal government as well.

“Less net income means less net revenue in taxes,” Meuser said. “We’re gonna be down, as the federal government, about $100 billion just in small business income tax because of that inflationary squeeze.”

Small businesses account for 99.9 percent of all businesses in the US and have accounted for nearly two-thirds of all job creation over the last 25 years. According to the National Federation of Independent Business, “unreasonable government regulations” ranks as a top problem for them.

Members of the committee were careful not to claim all government regulation on small businesses is bad. Rep. Morgan McGarvey (D-Ky.) emphasized that workers still deserve fair compensation and a safe working environment.

“You can be pro-worker without being anti-business,” McGarvey said.

This is not the first time the Department of Labor, or DOL, has come into conflict with a Republican-led House committee, as chairwoman Virginia Foxx and chairman Kevin Kiley of the committee on education and the workforce wrote a letter claiming the DOL neglected to consider how their rulemaking impacts small businesses.

“By failing to analyze the effects on small businesses adequately, DOL is undermining confidence in its rulemakings and engaging in rule by executive fiat,” Foxx and Kiley wrote in the letter.

Three weeks before the Small Business committee held their meeting regarding DOL regulations, the committee chairman, Rep. Roger Williams (R-Texas) sent two letters to the DOL addressing rule changes to the Fair Labor Standards Act (FLSA) and the Davis-Bacon Act. These letters claimed the rule changes disproportionately affected small businesses and were made without their consideration.

“It is important for agencies to examine small businesses interests, which make up 99.9 percent of all businesses in the United States, when passing any new rule. America’s small businesses deserve to have their voices heard and considered,” Williams said in the letter.

The Committee received two response letters on Wednesday. According to the committee, the responses did not answer the questions presented in the original letters.