WASHINGTON – Global investors Wednesday tried to make sense of what a Donald Trump presidency will mean for financial markets across the globe. As the possibility of the political outsider’s victory grew Tuesday night, markets worldwide reacted in largely negative ways before climbing out of the hole as trading opened in the United States.

But before things stabilized, markets saw a major selloff: of stocks, oil, and the Mexican peso, which was long seen as a proxy for investors weighing the chances of a Trump victory. . Gold and the Japanese yen, traditionally seen as havens of safety in tumultuous times, rose.

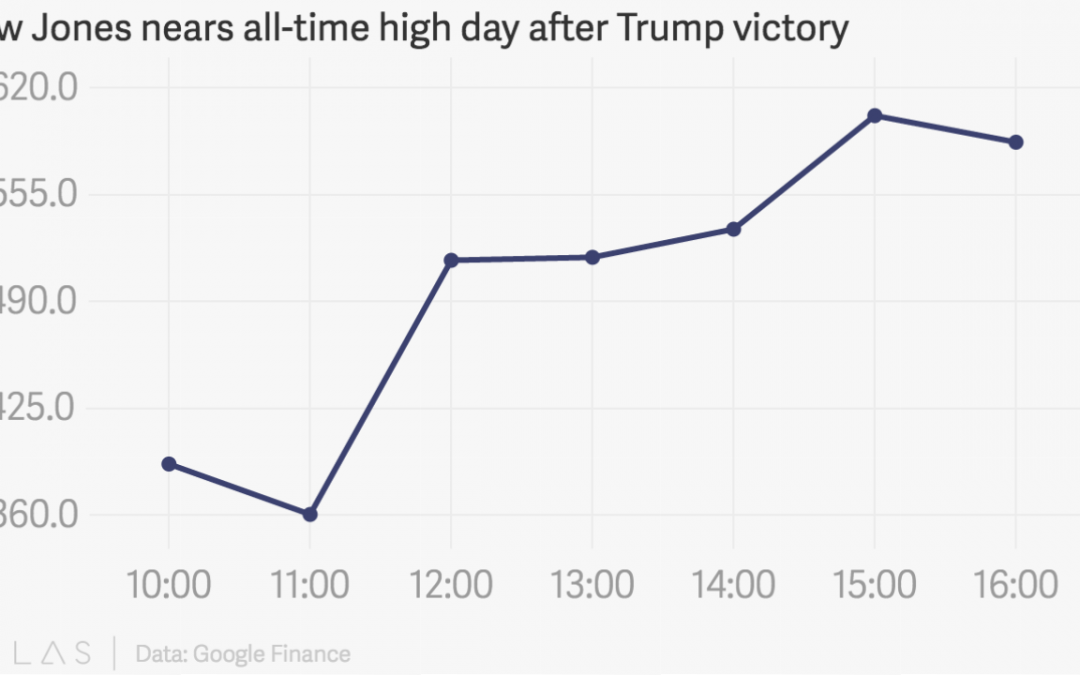

However, once Trump began his victory speech early Wednesday morning, congratulating Hillary Clinton on a hard-fought campaign and calling for unity, most markets began a gradual rebound. By the opening of trading in America, the dollar had largely recovered its losses and stocks in London ended roughly where they began the day. American stocks rose and the Dow soared 257 points, brushing up against lifetime highs.

“The initial reaction was one of real shock that people thought was going to be very disruptful,” said Desmond Lachman, a resident fellow at the American Enterprise Institute who researches the global macro-economy. “People began to calm down once you saw the transition was going to be smooth and Trump was conciliatory.”

Another market to watch, treasury bonds, fell sharply once Trump’s victory was guaranteed early Wednesday.

“People think long-term interest rates are going up,” Lachman said. “They think either that his fiscal policy will be pretty expensive, or that the Federal Reserve can now raise interest rates because the markets won’t totally tank.”

Two industries that saw gains in the first day of the post-election landscape were pharmaceuticals and private prisons.

Several major pharmaceutical companies saw their stocks rise sharply Wednesday. Pfizer’s shares climbed more than eight percent while Gilead Sciences, the largest pharmaceutical company in the world by revenue, saw its shares rise by over six percent.

The two largest private prison companies, CoreCivic, previously known as Corrections Corporation of America, and GEO Group, saw their stock rise by more than 40 percent and 20 percent, respectively.

“Those seem to be the sectors that would benefit from his fiscal plan,” said Lachman. The think tank analyst said the possibility of a Trump presidency had not been priced in before Tuesday night, causing a sharp correction once it became clear he was likely to defeat Clinton.

Throughout his campaign, Trump said election night could turn into a Brexit moment of sorts for America, referencing the United Kingdom’s vote in June to leave the European Union. That result surprised many pollsters and betting markets that mostly predicted the opposite outcome. Most U.S. polls favored Clinton going into the Tuesday election.

Markets reacted negatively in June after Brexit, much like Tuesday night.

The next big event to watch for, Lachman said, is the Italy’s constitutional amendment referendum in early December.

“Maybe that is going to shake things up again if people see there’s a real populist movement gaining ground globally,” he said.