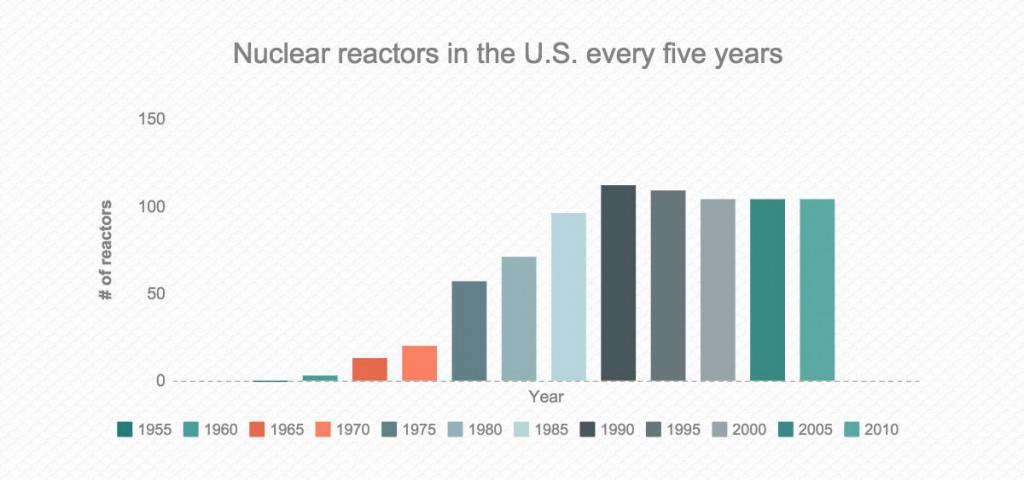

Construction of new nuclear reactors came to a halt for years amid questions about cost and safety. (Source: Energy Information Administration)

WASHINGTON – Thirty-seven years after a partial nuclear meltdown at the Three Mile Island power plant stunted the growth of the burgeoning U.S. nuclear industry, Vogtle Electric Generating Plant in Georgia is building two reactors that will turn the plant into the biggest nuclear generating station in the country.

The new units will allow the Vogtle plant, which already operates two reactors, to produce enough energy to power more than 1 million Georgia homes and businesses. But what makes the project notable is that prior to this, the Nuclear Regulatory Commission had not approved a construction permit for a nuclear plant since 1978, one year before a faulty relief valve at Pennsylvania’s Three Mile Island led to the worst nuclear accident in U.S. history.

Underway since getting NRC approval in 2012, the Vogtle plant project is three years behind schedule and billions of dollars over budget. The project was initially expected to cost $14 billion but could reach upward of $21 billion, Georgia Public Service Commission filings indicate.

The setbacks embody the dilemma faced by the nuclear power industry: Plants are cheap to run but expensive to build. Skeptics question whether long-term savings justify massive upfront costs. And what happens when the plants need repairs that could cost billions of dollars more?

When construction on Vogtle’s first reactor began in 1974, nuclear energy in the U.S. was on the upswing because it was cheap and burned clean – and there had been no major disaster to shape public perception of its safety.

But in 2016, the industry faces stiffer competition from alternative energy sources. In 1977, for instance, solar panels cost $76.67 per watt, according to a Bloomberg New Energy Finance report. That figure had decreased to 73 cents by 2012 – less than 1 percent of the original per-watt cost. And aside from Three Mile Island, the 1986 Chernobyl disaster in Ukraine and the tsunami-induced accident at Japan’s Fukushima Daiichi plant in 2011 have damaged the industry’s image.

This was not always the case. The nuclear industry received a boost from the oil embargo imposed by Egypt, Syria and Arab OPEC countries from October 1973 to March 1974, which quadrupled the global price of oil, according to the State Department. The ensuing economic crisis – further aggravated by the devaluation of the dollar – coincided with a period of volatile oil prices throughout the 1970s and into the early 1980s. As electricity demand grew, so did the need for stable and efficient energy.

“There was this recognition that if you could find energy sources that weren’t reliant on oil and the geopolitics that came with it, you would be in a much more favorable position going forward,” says Matt Crozat, senior director of business policy at the pro-industry Nuclear Energy Institute.

The nuclear industry seized the opportunity. By 1972, 15 years after the first U.S. nuclear power plant opened, 27 nuclear reactors operated across the country. Two years later, that figure had more than doubled to 55.

But around this time, the Nuclear Regulatory Commission began tightening safety regulations, a trend accelerated by Three Mile Island. The NRC increased the amount of steel, concrete and other materials needed to build a power plant. When experiences at the plants indicated the new regulations were excessive, the agency did not pull back its requirements, according to physicist Bernard Cohen’s 1990 book, “The Nuclear Energy Option.” Instead, the regulations tightened.

Though the U.S. now operates 99 reactors, more than any other country by a wide margin (France is second with 58), it once had as many as 112. The number of operational reactors in the country has either declined or remained constant in every year since 1993, data from the U.S. Energy Information Administration show.

Dave Lochbaum, director of the Union of Concerned Scientists’ Nuclear Safety Project, points to an underlying challenge for power companies beyond the initial cost of building a nuclear plant: attempted repairs that fail and cost billions to fix. When workers inadvertently cracked the wall of the Crystal River nuclear plant in Florida in 2009 while trying to replace the plant’s steam generators, the plant shut down because it would have cost upward of $1 billion to repair the damages.

Four years later, the San Onofre nuclear power plant in California closed because its replacement steam generators were prematurely wearing out, even though the generators received upgrades a few years prior that were designed to improve their durability.

Crozat and Lochbaum say the cheap price of natural gas, rapidly declining due largely to the hydraulic fracturing boom, puts pressure on nuclear plants. Small single-reactor plants such as the Vermont Yankee Nuclear Generating Station and the Kewaunee nuclear power plant in Wisconsin closed within the last three years because of plummeting natural gas costs. Entergy Corp., which owned Vermont Yankee, announced that it plans to close another nuclear plant in New York this year for the same reason.

But, Crozat points out, existing plants have been upgraded to improve their generating capacities. The number of reactors in the U.S. only tells part of the story, he argues.

“There has been an extension of nuclear capacity over the last two decades in particular,” Crozat says. “We’ve added about the equivalent of seven reactors’ worth of additional capacity by upgrades – going back and retrofitting plants or equipment – and that allows for higher output operations. So, we have seen the overall scale grow in that [regard].”

Improved capacity has essentially canceled out the impact of plant closures. The U.S. operates five fewer plants than it did in 2012, but net summer capacity – measured when energy demand peaks from the beginning of June to the end of September – has dropped only slightly, remaining between 97 and 102 million kilowatt hours since 1998, according to the Energy Information Administration.

Power companies hoping to upgrade their plants instead of building new ones face financial challenges. For instance, a four-month project at the Monticello Nuclear Plant in Minnesota to upgrade capacity and replace old equipment cost nearly twice its initial estimate. The upgrades cost a fraction of the price of building a new plant, but still blew past initial cost calculations.

If the nuclear industry fades as reactors expire after being deemed too expensive to maintain, the U.S. will lose a greenhouse gas-free source of electricity that makes up 20 percent of its electricity generation, according to the EIA. Some wonder if the environment and the unquenchable U.S. demand for cheap energy can withstand the loss.

According to a report released in 2015 by the International Energy Agency and the Nuclear Energy Agency, global nuclear power capacity would have to double by 2050 to avoid a 2 degree Celsius global temperature increase. The U.S. is constructing five reactors to complement its 99 operating ones, placing a burden on the rest of the world that could be too much to shoulder.

Power companies may have to change the way they build plants to avoid repeating the budget overruns and delays of the Vogtle plant’s current project. Lochbaum says the construction plan for the new Vogtle reactors – assembling parts at factories, then shipping the finished parts to the construction site instead of assembling them there – was well-intended and makes sense on paper.

But a consortium of companies is responsible for supplying the parts, Lochbaum says, so construction relies on multiple contractors to deliver parts on time. And when each step must be completed to move on to the next, a single delay slows the entire process.

“Basically, the schedule is being dictated by the slowest part,” Lochbaum says. “They knew people would be a day or two late, but it’s been more than a day or two, and each delay slows down everybody else and just causes the price tag to go up and up.”

According to Jacob Hawkins, spokesperson for Georgia Power, a subsidiary of Southern Company and owner of the largest share of the Vogtle plant, “progress is being made every day at the Vogtle nuclear expansion, now more than 60 percent complete based on contractual milestones. This facility will deliver more affordable and reliable energy for our customers for generations to come and completing the facility continues to offer overwhelming economic benefits for customers.”

The costliness of building and upgrading nuclear plants could be mitigated by a simple solution: Build smaller plants. Normal-sized reactors such as those being built at Vogtle generate upward of 1,000 megawatts; the capacity of Small Modular Reactors (SMRs) – 300 megawatts – makes them cheaper to construct.

Crozat says smaller reactors “provide an option for deploying nuclear that wouldn’t exist otherwise” for smaller companies that cannot afford 2,000-megawatt facilities. And companies that build several Small Modular Reactors at the same site can use money coming in from the first reactor to help fund the construction of subsequent ones, Lochbaum says.

The NRC, which approves the design of reactors before granting them licenses to operate, is expected to receive applications for “design certifications” for small reactors during the next several years, according to the Nuclear Energy Institute. But Small Modular Reactors may not operate in the U.S. until 2025, the Department of Energy says. And they are not guaranteed to work.

“The biggest hurdle that SMRs face is that the reactors that are being built today in the United States – the five reactors that are in various stages of construction – are basically the next evolutionary step to the reactors we’re already operating,” Lochbaum says. “And the SMRs are pretty much different from that. They’re more revolutionary in their design, and that’s going to cause a problem for plant owners. It’s difficult to invest a lot of money in a technology that may have some unforeseen problems.”

The nuclear industry’s clock continues to tick because plants have finite lifespans. Reactors are typically designed to last around 40 years. Simple math illustrates a sobering reality for power companies: We will need to see a slew of costly reactor upgrades for the country’s aging plants to remain operable.