WASHINGTON — Economic growth trended above historical levels in January, indicating a jump in production and a decreased likelihood of recession, according to a key index from the Federal Reserve Bank of Chicago.

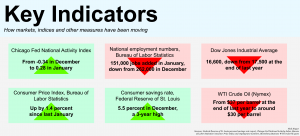

The Chicago Fed National Activity Index, which tracks 85 economic indicators, rose to 0.28 last month, up from a lower-than-average negative 0.34 in December 2015. Led by broad increases in production and employment, January marked the first time the index has risen above zero since August, suggesting strong economic performance despite a volatile stock market and global financial concerns.

The index’s three-month moving average, designed to control for volatility in the index, also saw gains in January, rising from negative 0.30 in December to negative 0.15. Historically, this average has fallen below negative 0.7 near the onset of every recession identified by the National Bureau of Economic Research. So last month’s move toward a positive trend signals good news.

However, the moving average also indicates that inflation, an important measure used by the Federal Reserve in making interest rate decisions, will not rise in the near future – sustained inflation is signaled by a value above 0.7 on the average.

“The economic growth reflected in this level of the CFNAI-MA3 (the three-month moving average) suggests subdued inflationary pressure from economic activity over the coming year,” the index report says.

This prediction comes despite higher-than-expected Consumer Price Index levels from the Bureau of Labor Statistics in January, which track how expensive consumer goods are as a measure of inflation. Although unchanged since December, that index rose 1.4 percent since January of last year, indicating increased inflation for the year, 2015.

While the new data from Chicago argue against talk of a recession, James Angel, a professor at Georgetown University’s McDonough School of Business, said the current economic expansion has been going since the recession ended in mid-2009and that growth will have to slow eventually.

“At some point, this expansion is going to run out of steam, and we’ll hit a recession,” Angel said, adding that financial troubles in Europe and China have already had l have an impact on the U.S. market.

And there are signs that confidence in the economy hasn’t trickled down to the general population. The consumer savings rate was 5.5 percent in December, according to the Federal Reserve of St. Louis, the highest it has been in three years. This despite falling oil prices, which lead to lower gas prices at the pump and should stimulate consumer spending. That people are instead choosing to save their extra money could indicate a lack of confidence in the future of the economy.

The stock market also saw a volatile start to the year. The Dow Jones Industrial Average plummeted from nearly 17,500 at the end of last year down to 15,800 in mid-January. And while it is now hovering around 16,400, it has closed below 16,000 six times so far this year, due to worries about low oil prices and the Chinese market. Treasury bond yields have also been sliding over the past month, indicating higher demand for low-risk investments.

There will be much to watch later in the week – the S&P/Case-Shiller Home Price Index comes out Tuesday, the Bloomberg Consumer Confidence Index on Thursday and last year’s GDP numbers Friday. Taken together, these major indicators should paint a clearer picture of recent economic performance and give a good hint of what the near future will bring.

And despite positive short-term numbers, Angel expressed concern about the long-term outlook for the economy, citing decaying infrastructure, climate change and an aging population as major barriers to growth in the long run.

“The long-term returns in the economy are driven by productive growth,” he said. “If we don’t deal with our long-term challenges, there’s not going to be long-term growth, and stock returns are going to be bad.”