WASHINGTON – The chairman of an influential House committee called Wednesday for a “complete overhaul” of the federal Small Business Administration operations because of at least 10 years of investigations showing lax loan oversight and lack of security for its digital files.

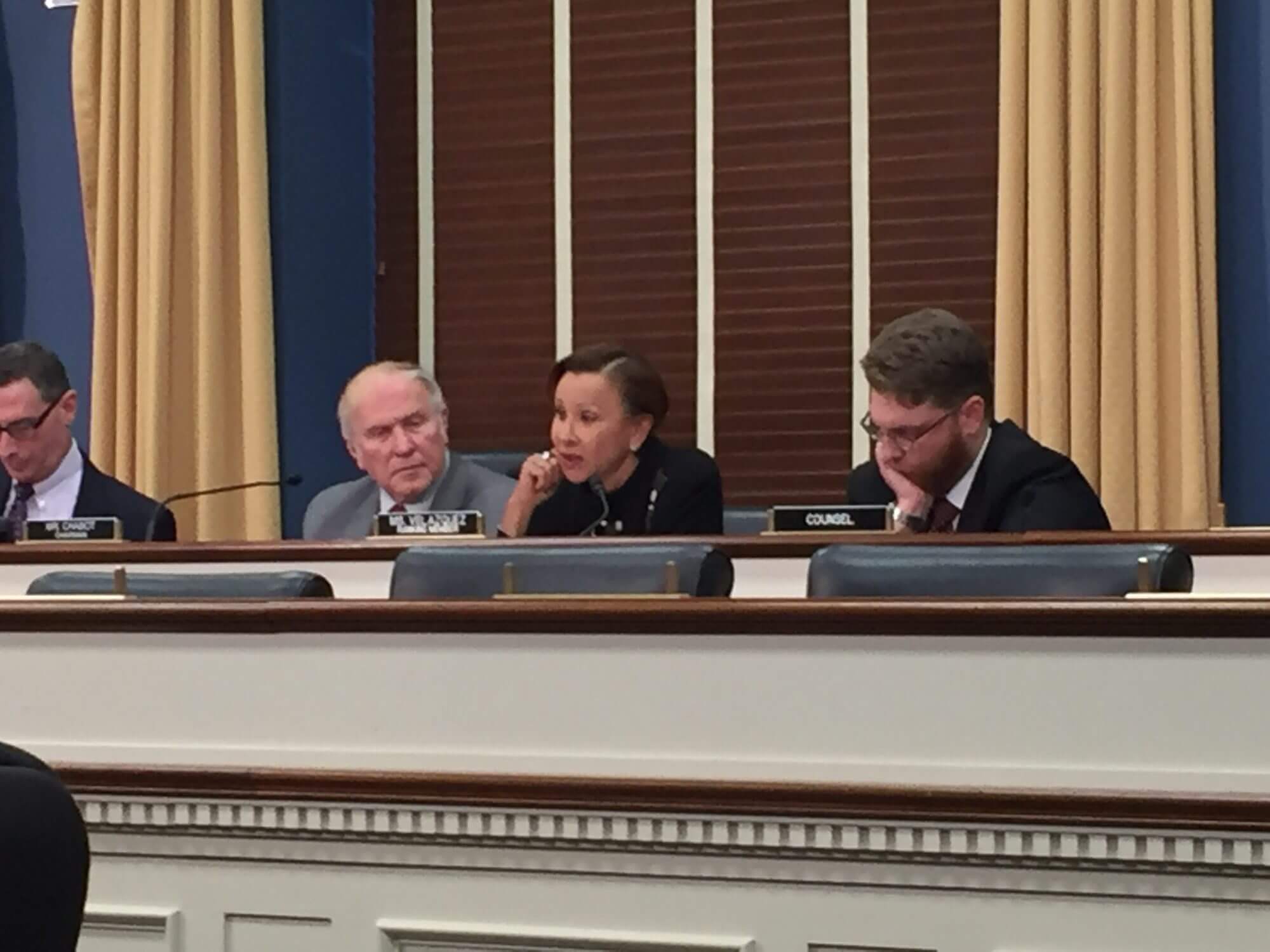

The House Small Business Committee reviewed a report published by the Government Accountability Office in September, focusing on the SBA’s lack of response to previous GAO recommendations.

Some concerns, including IT security flaws and inadequate loan oversight, have been reported for 10 years or more without being addressed, according to the report. And while the panel’s chairman, Rep. Steve Chabot, R-Ohio, did not expect the problems to be resolved quickly, he made it clear that progress to fix the problems needs to happen soon.

More hearings are on the way to look into SBA programs, but “the committee will not hesitate to take legislative action,” if administrators don’t act, Chabot said.

“These are challenges that have been around, and it’s very disturbing to us that these challenges still remain,” said the GAO’s financial services chief William Shear. Of 69 previous recommendations made by the GAO, the SBA has only implemented seven, according to Shear. He said top administrators are insulated from information about the daily operational problems so they don’t see the need for changes.

The report also raised concerns about loan oversight, citing “hundreds of millions of dollars” in fraud committed by loan agents. The GAO recommended a number of measures to increase loan security, including implementing a registration system for lenders or logging agent activity in a database. As of March of last year, according to the report, the SBA had a loan portfolio of about $117 billion.

Shear questioned the effectiveness of the SBA’s disaster loan program, which helps businesses and property owners in rebuilding after a declared disaster. He said there does not appear to be a plan for a large-scale event like Hurricane Sandy.

“The ball was dropped by the SBA,” he said.

According to Dan Bosch of the National Federation of Independent Business, many small business owners don’t apply for SBA loans, but NFIB members still would like the process to be streamlined.

“Government mismanagement is a prime example of why NFIB members oppose intrusive federal regulations and sadly the Small Business Administration is no exception,” Bosch said.

SBA Administrator Maria Contreras-Sweet plans to explain actions the agency has taken to address the GAO report’s list of problems. A spokesman said the SBA has a new top technology official to lead an upgrade of computer systems for “greater capacity, reliability and security. … This modernization complements the agency’s existing work to update our lending partner platforms through automation, digital signatures and online matchmaking.”

A second hearing with testimony from Contreras-Sweet is set for Thursday.