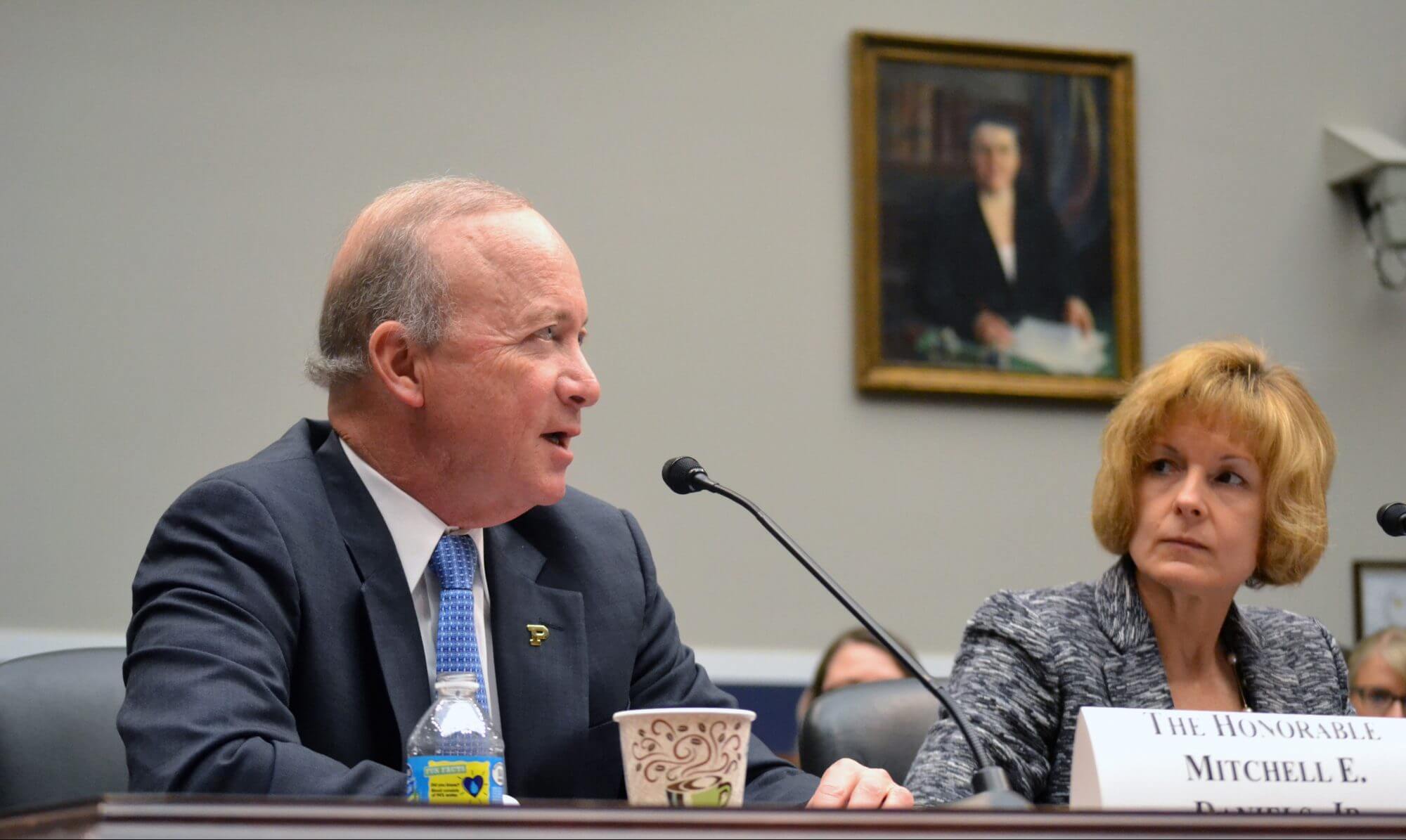

Mitch Daniels, president of Purdue University and former governor of Indiana, talks about his institution’s successes with making higher education affordable. (Photo by Preston R. Michelson/MNS)

WASHINGTON — High tuition prices and complicated student aid in higher education have not kept pace with the nation’s needs.

“Today’s higher education resources are incomplete, inaccurate and often complicate the financial aid process, misguiding students about their academic and financial options,” said Rep. Virginia Foxx, R-N.C., chairwoman of the House Education subcommittee on higher education and workforce training.

The hearing Tuesday was called to debate the reauthorization of the “Higher Education Act,” a law that mainly governs federal student aid programs. Technically, it expired in 2013.

“Postsecondary education builds the knowledge, skills and abilities of a workforce that are necessary for economic growth,” said David Bergeron, vice president for postsecondary education policy at the left-leaning Center for American Progress.

Seven in 10 seniors who graduated from public colleges in 2013 had student loan debt with an average of $28,400 per borrower, according to a report by the Institute for College Access & Success.

That debt is having a profound impact –20- and 30-year-olds are delaying having children, getting married and purchasing homes, according to the Pew Research Center.

Mitch Daniels, president of Purdue University and former governor of Indiana, approved a tuition freeze for the university in 2013, which cost the school tens of millions of dollars and, to offset the money, he established a wage freeze on all employees. The program will last until the end of this school year.

“Total debt has dropped 18 percent, or some $40 million, in those [years], such that now our graduates with debt owe amounts well below the national average,” Daniels said.

The panel discussed ways to reduce those costs — from regulatory reform to simplifying the 110-question FAFSA, a widely-used application for student loans. However, Michael Bennett, associate vice president for financial assistance services at St. Petersburg College in Florida warned against making the application “too simple.”

“A dramatic change would have extremely damaging consequences,” he said. “The fewer the data elements we collect, the more homogenous everyone appears, making it impossible to differentiate those who appear needy from the truly needy.”

Once students have financial aid, they also need to know how to manage their finances.

“One online entrance and exit loan counseling session is not enough for some students to fully understand the realities of excessive debt and over-borrowing,” said Bennett. “We also must embrace at the institutional level the importance of financial literacy.”

There is no plan in place to bring the reauthorization legislation to the House floor. Until the law is updated and changed, the version that was enacted in 2008 remains in place.

“If we are to maintain our current advantage, we will need to make changes, starting now,” Daniels said. “It’s an opportunity not to be missed.”