WASHINGTON — Ordinarily, Chairman Sherrod Brown, D-Ohio, begins each hearing in the Senate Banking Committee with an opening statement on the matter at hand, but he was beaten to the punch on Wednesday by JPMorgan Chase CEO and billionaire establishment Democrat mega-donor Jamie Dimon.

Minutes before senators entered the room, Dimon walked in and turned to the crowd, puffing out his chest and issuing a reverberant greeting: “Good morning! They should make you pay to come to this!”

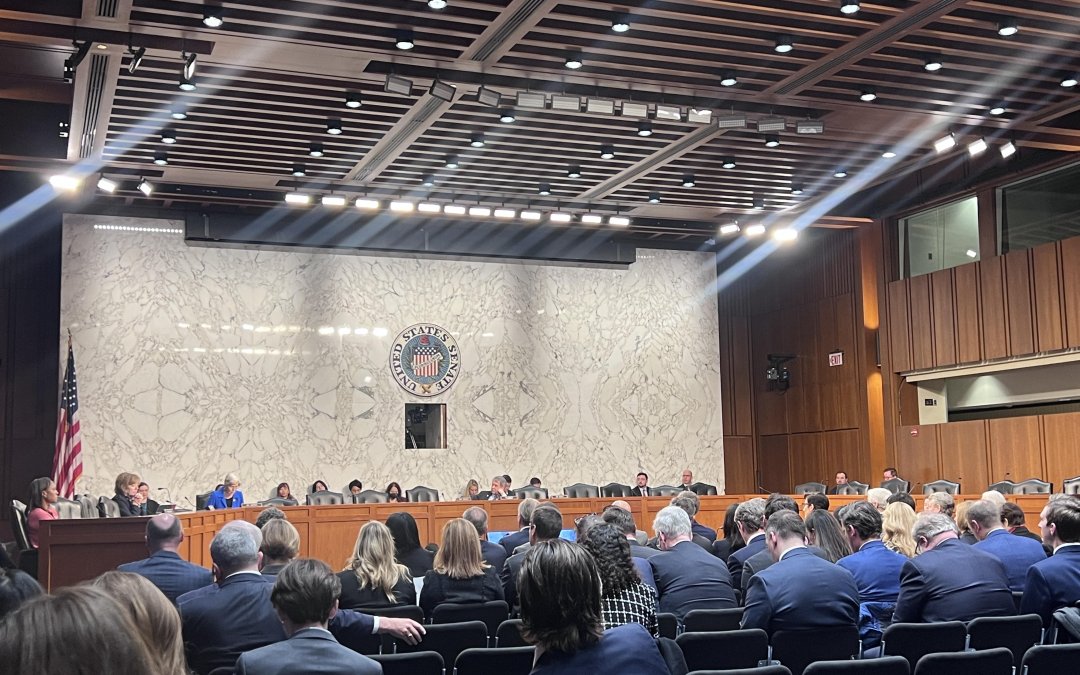

Shortly after, senators sparred with some of the wealthiest corporate executives from the most powerful banks in the country over regulations and corporate lobbying in the committee’s annual hearing to conduct oversight of Wall Street firms on Wednesday.

Brown gaveled the hearing into session and proceeded with a scathing opening statement, decrying Wall Street firms’ lobbying efforts against recent regulation proposals and condemning the reckless corporate conduct that has negatively impacted working-class Americans’ access to equal opportunity.

The chairman said the “enormous” influence that banks and their CEOs wield should come with reasonable regulation and significant responsibility to protect American consumers’ best interests.

“You may be private companies, but the risks you take and the mistakes you make don’t just affect you. They don’t even just affect your customers, not even just your shareholders, not even just your workers,” Brown said. “The mistakes you make affect the whole economy, and as we all remember from 2008 and 2009, they can certainly affect American taxpayers.”

Alongside Dimon, other banking CEOs called to testify before the committee as expert witnesses included Charles Scharf from Wells Fargo, Brian Moynihan from Bank of America, Jane Fraser from Citigroup, Ronald O’Hanley from State Street, Robin Vince from BNY Mellon, David Solomon from Goldman Sachs and James Gorman from Morgan Stanley.

The banks owned by these eight CEOs collectively hold nearly $15 trillion in assets and trillions of dollars in investments. They also hold more than half of the deposits in the United States and more than $80 trillion in client assets. Brown dubbed these corporate executives “eight of the most powerful people in the country.”

Before the hearing commenced, several senators walked down to the witness podium and jovially greeted each of the eight corporate CEOs, which does not normally happen between committee members and expert witnesses before testimony or questioning.

During the hearing, however, exchanges were sometimes less friendly.

Senators debated mostly along party lines about whether corporate executives or bureaucrats in Washington, D.C. were primarily responsible for adverse economic consequences on American consumers and working-class citizens.

Indeed, while Democratic committee members pressed the banking CEOs about their resistance to reasonable regulations, Republican senators sided with the private sector titans, suggesting that government intervention in Wall Street firms’ dealings would actually hurt average people more.

Sen. Elizabeth Warren, D-Mass., pressed Dimon and the other executives on criminals’ use of major banks and cryptocurrency to facilitate transactions that ultimately fund terrorists, drug traffickers and sanctioned countries.

Warren said terrorists are now using “cryptocurrency” to circumvent obstacles previously created by the Bank Secrecy Act in 1970 so they can continue to use American banks for bad-faith financing.

“I believe that none of you want your banks to be used to finance terrorist attacks, but let’s be clear: none of you runs these anti-money laundering programs out of the goodness of your hearts,” Warren said.

Dimon echoed Warren’s concerns about cryptocurrency, saying if he had “a government role,” which some argue he already does through mere financial influence, he would “shut down” cryptocurrency due to the threats it poses in being exploited by bad actors.

In March, the Federal Reserve and Treasury Department fined Wells Fargo $125 million for allowing a foreign bank to make hundreds of millions of dollars in transactions on its platform and thus violating prohibitions on dealing with Iran, Syria and Sudan, which are all presently subject to U.S. sanctions.

Scharf brushed over the significance of this previous sanction violation, further ensuring his bank’s general commitment to rooting out illicit transactions.

“Preventing bad actors from abusing our services is a top priority,” Scharf said. “We work in industry groups, we work with the government, we work with the regulators to make sure that we’re doing everything we possibly can to prevent that abuse.”

Despite several senators’ concerns, the corporate CEOs continued to emphasize the important role they believe their banks play in trickling wealth and opportunity down through the economy.

Dimon touted the role he feels Chase banks play in creating jobs for ordinary Americans, growing wealth for the U.S. economy and representing national interests abroad. He said large banks are the “guardians of the financial system.”

“The country benefits from thousands of banks and credit unions of all sizes serving all corners, and we must acknowledge that there are some things that can only be done by large and complex banks, things that are essential to a thriving U.S. economy and American competitiveness,” Dimon said. “Our collective work is important in good times but essential in troubled times.”

The executives also called on Congress to impose less stringent restrictions on their institutions and allow them to navigate the market freely.

Gorman expressed particular frustration with Congress’ most recent proposed regulations that specifically target excess fees imposed by banks and other financial institutions.

“This doesn’t make sense,” Gorman said. “You shouldn’t punish institutions for making fee-based businesses.”

Some senators echoed this sentiment, scapegoating “Washington bureaucrats” for the lack of American working-class opportunities.

Among senators who appeared keenly receptive to the corporate arguments, Sen. John Kennedy, R-La., thanked the CEOs for their contributions to the U.S. economy and directed subtle shots at Democratic colleagues who had pressed them earlier in the hearing.

“Unlike some, I do not think you are crooks,” Kennedy said. “In fact, you’re all American companies and I’m proud of you. And I thank you for supporting the most sophisticated and powerful economy in all of human history, and the jobs you create for Americans in doing it.”

Other senators assigned the blame to corporate greed and unregulated wealth monopolization on Wall Street, commending the CFPB for clawing back funds from banks.

Sen. Bob Menendez, D-N.J., who still attends committee hearings despite facing broad calls to resign after being indicted on federal bribery charges and allegedly conspiring to act as a foreign agent for Egypt, pressed each CEO about the money they had to return to customers in redresses at the direction of the Consumer Financial Protection Bureau in the last 12 years.

Menendez revealed that CFPB clawed back $360 million from JPMorgan Chase, $819 million from Bank of America, $1 billion from Citigroup and $2 billion from Wells Fargo, which he said would have come “out of the pocket of American consumers” without the bureau.

“From just the four of you, that’s over four billion dollars returned to hard-working consumers in the past dozen years,” Menendez said. “And yet this critical agency is under constant attack from my Republican colleagues. A lawsuit before the Supreme Court is threatening its very existence. And time and time again we’ve seen why the CFPB is so necessary.”

Senators will have one week to submit questions for the record, which the banking CEOs will then have 45 days to answer as lawmakers continue to quarrel over how to grow the economy and whether regulating Wall Street firms will return prosperity to the average American consumer.