WASHINGTON — Despite high consumer prices and rising interest rates, the U.S. economy surged this summer, driven largely by consumer spending.

Gross Domestic Product (GDP) rose at a 4.9% inflation-adjusted annual rate in the July-through-September period, up from 2.1% in the second quarter, the Commerce Department reported last Thursday. The GDP increase marks the biggest rise seen since late 2021.

The increase in consumer spending that drove GDP growth came largely from both services and goods. Services included housing and utilities, health care, food service, etc., while the increase in goods came from nondurable goods (led by prescription drugs), recreational goods and vehicles. Spending on leisure and entertainment—including Taylor Swift’s Eras Tour and the “Barbie” movie—also contributed to GDP growth.

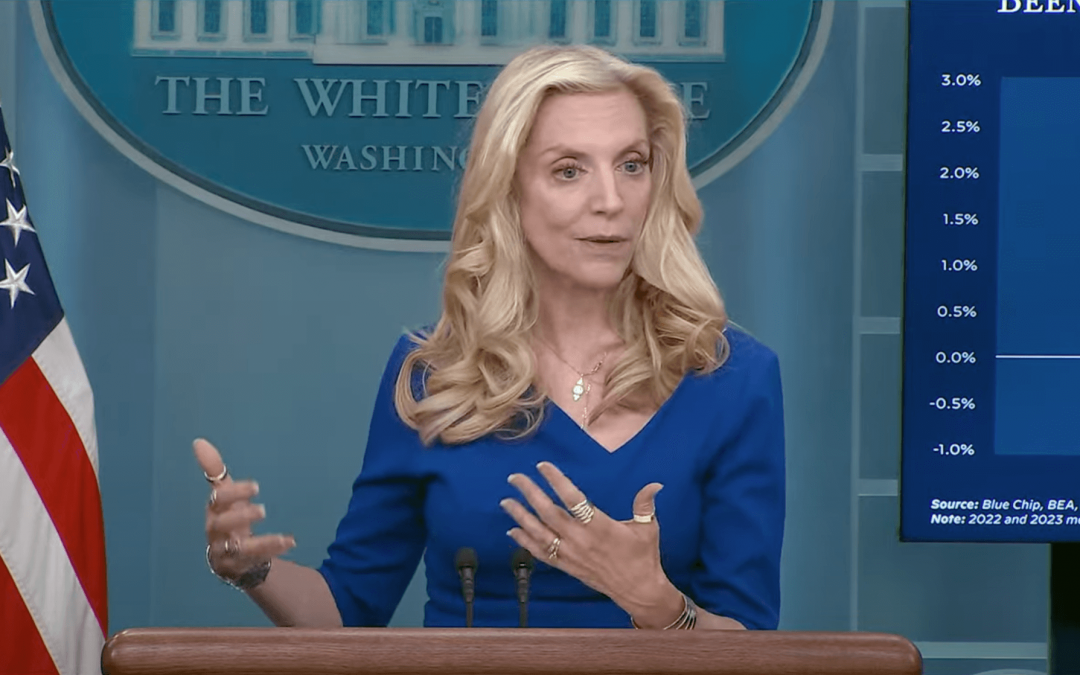

“The U.S. consumer, U.S. workers — they are absolutely the reason that we’re seeing this resilience in the economy,” National Economic Council Director Lael Brainard said at a White House press briefing on Thursday.

On top of consumer spending, the increase in real GDP reflected increases in private inventory investment, exports, state and local government spending and federal government spending, according to the Commerce Department report.

Business investment dipped for the first time in two years.

What does this mean for consumers?

Americans have rejoined the labor force in record numbers and real wages are up over the last year. Inflation fell to a yearly rate of 3% in June, down from 4% in May and much lower than June 2022, when inflation peaked at 9.1%. But prices of goods and services still remain high.

After accounting for inflation, Americans’ median net worth is 37% higher than it was before the pandemic, according to a survey conducted by the Federal Reserve Board. Wealth gains were strongest for the bottom half of the income distribution, as well as for Black and Hispanic families that have traditionally not seen as large gains.

“Data, which have been sustained now for a relatively long period of time, suggests that there’s ongoing resilience there,” Brainard said when asked if the National Economic Council predicts a recession may be coming.

But others say the strong GDP growth seen this summer is unlikely to last, especially with the recent resumption of student loan payments and the possibility of a federal government shutdown looming.

What are economists saying about the growth in GDP?

JPMorgan economists project annual GDP growth to slow to 1.5% during 2023’s final quarter, And “at least a 50/50 chance of a recession starting by the end of 2024, [with] a greater chance of a recession in 2025 if one fails to materialize earlier.”

Mark Zandi, chief economist of Moody’s Analytics, had a more positive outlook.

“Today’s GDP report shows the economy’s extraordinary resilience. Consumers are doing their part, businesses are hanging tough, and the infrastructure legislation and CHIPS Act are providing a tailwind,” he wrote in a social media post on Thursday. He added that “growth will soon throttle back,” but that the report should allay any worries of a recession.

The Dow Jones Industrial Average dropped Thursday after the GDP report was released.

What is the White House saying?

The Biden Administration is touting this rise in GDP as a result of Biden’s economic agenda.

Brainard said the consensus view a year ago was that unemployment would need to go up to 4.5% and that the economy would need to stall out in order to get inflation down to where it is today. She said Thursday’s report proved that the economy under Biden has grown, while inflation has simultaneously reduced.

Biden echoed these sentiments in a statement released on Thursday.

“It is a testament to the resilience of American consumers and American workers, supported by Bidenomics — my plan to grow the economy by growing the middle class,” Biden said.

Bidenomics is a key aspect of the president’s reelection campaign.

Biden will need to keep pushing these results if he wants to convince voters, however, as polling shows that Americans overall are still uncertain that the economy is truly strong, and that voters believe Republicans are better at dealing with economic issues.

What are Republicans saying?

Republicans have been largely silent on the recent GDP report.

Senate Minority Leader Mitch McConnell did not issue a statement, and neither did new House Speaker Mike Johnson; however, he did say that the “economy is in the tank” in a Fox News interview on Thursday.

The Republican National Committee has not issued a new statement, but called Bidenomics a failure in a statement released on Oct. 23.

“Prices are up, real wages are down, and Americans’ confidence in Biden’s handling of the economy is in the gutter… it is clear Biden doesn’t care,” the statement said. No data was included to back up these claims.

Republicans are staunchly opposed to Biden’s economic agenda, and have been quick to blame Democrats’ “reckless spending” as the cause of inflation.