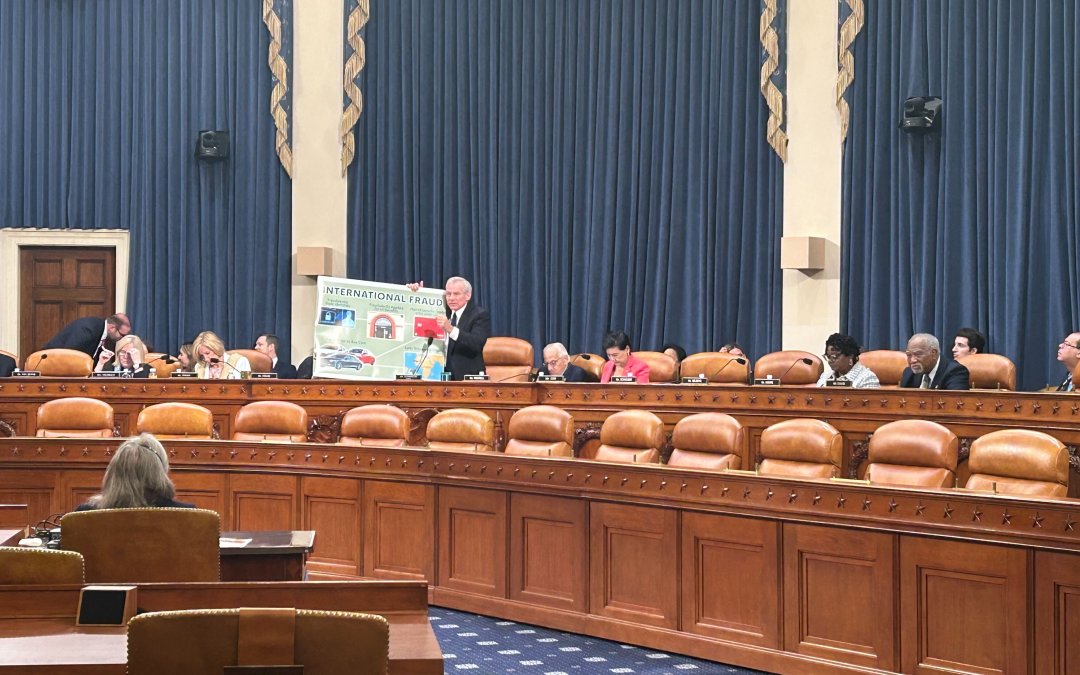

WASHINGTON — The U.S. government’s current response to pandemic-related fraud is outdated and not fit to fight back against dynamic foreign adversaries, experts warned at a House Ways and Means Oversight Subcommittee hearing on Thursday.

One solution could be emerging technology, including artificial intelligence.

A report by the Government Accountability Office (GAO) released in September estimates that the total amount of fraud across all unemployment insurance (UI) programs, including the new emergency programs, during the COVID-19 pandemic was likely between $100 billion and $135 billion—or 11% to 15% of the total UI benefits paid out during the pandemic.

Just last week, two Nigerian nationals were sentenced for schemes to steal California and other states’ UI benefits. Together, they were involved in over $1.5 million in attempted theft.

House members at Thursday’s hearing questioned witnesses on how to prevent foreign actors from exploiting future pandemic-related relief funds.

Experts said more technology should be integrated into fraud prevention.

“Building a newer, more modern system improves equity of access and security, which go hand-in-hand with fighting fraud,” said New Jersey Labor Commissioner Robert Asaro Angelo.

Linda Miller, founder and CEO of Audient Group, a consulting firm offering solutions to fraud and improper payments, agreed, saying that the government currently has “very, very static” processes and “antiquated” data systems which allow for widespread fraud.

She suggested that Congress direct the creation of a fraud analytics center of excellence that uses risk models, machine learning and AI to drive efficiency in data collection.

The fraud analytics center of excellence would work to prevent fraud, rather than combat it once it has already happened.

“We could use large language models, like generative AI and ChatGPT and, within seconds, we could identify text that’s duplicative and indicates that someone is [committing identity fraud],” Miller said. “This can be done in seconds if agencies adopt these technologies.”

Miller said that the private sector is already implementing these technologies, and that the government must follow their lead.

But the issue, experts said, is that agencies have no incentive to implement the technology when there is no money allocated to do so.

“There is not a dedicated line of funding for fraud—I think there should be,” said Amy Simon, principal of consulting firm Simon Advisory. “The dollars are not prioritized to [prevent fraud], but the tradeoffs are extremely steep for states, so if we want fraud to be part of the mission, the funding must include fraud-specific funding.”

Miller suggested that the government should earmark fraud prevention funds in large spending bills in order to get that dedicated line of fraud prevention funding, which could be put towards emerging technologies.

Along with bolstering funding, experts emphasized the importance of states working with other states to further fraud prevention.

Asaro Angelo said his home state of New Jersey, which he claimed halted hundreds of thousands of fraudulent payments during the pandemic, is already collaborating with other states to share findings, trends and best practices.

“It’s vitally important we continue supporting efforts for national improvements to create overarching systems that work with each other, instead of having each state operate independently,” Asaro Angelo said. “Fraudsters love nothing more than having 53 separate systems to pick through to see which can be hit easiest and hardest.”

Asaro Angelo said that there is no “silver bullet” to completely eradicate fraud from our benefits systems, but that governments can and should combat it in every way possible —by continually learning, training and building on growing technologies so we can “stay one step ahead” of fraudulent actors.

Subcommittee Chair David Schweikert (R-Ariz.) said the solutions offered in Thursday’s hearing will be considered going forward.

“You did something unique as a group, all of you,” he said to the line of witnesses. “You actually gave us a path where we think we can do something positive and maybe make the future more robust.”